4 Ιουνίου 2010

Π. Γκρούγκμαν-ΤΟ ΝΑ ΕΧΗΣ ΤΟ ΙΔΙΚΟΝ ΣΟΥ ΝΟΜΙΣΜΑ ΚΑΝΕΙ ΤΗΝ ΔΙΑΦΟΡΑ

June 3, 2010, 4:59 AM

PAUL KRUGMAN

{ΤΟ ΝΑ ΕΧΗΣ ΤΟ ΙΔΙΚΟΝ ΣΟΥ ΝΟΜΙΣΜΑ ΚΑΝΕΙ ΤΗΝ ΔΙΑΦΟΡΑ}

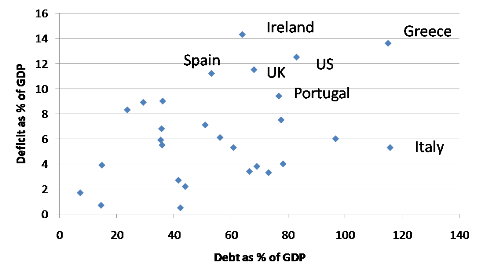

The horizontal axis shows gross debt as a percentage of GDP at the end of 2009; the vertical axis shows the budget deficit as a percentage of GDP in 2009. Each point represents one advanced economy; I’ve labeled a few countries of interest. Japan is, literally, off the chart, with enormous debt and a large deficit.

As you can see, I’ve identified the GIPSIs — the Club Med plus Ireland countries that are facing serious questions about solvency. As you can also see, by the debt-and-deficit criteria the US, UK, and (as you can’t see) Japan look similar enough to the crisis countries that if you didn’t know better, you might expect them to be in the same boat.

But they aren’t. As of right now, the interest rates on 10-year bonds are 3.59% in the UK, 3.36% in the US, 1.29% in Japan. CDS spreads for Japan and the UK are only about a third of the level for Italy.

So what does one make of this? One possible answer is, just you wait — any day now there will be a Wile E. Coyote moment, the markets will realize that America is Greece, and all hell will break loose. The other answer is to note that all the crisis countries are in the eurozone, while the US, UK, and Japan aren’t — and to argue that having your own currency makes all the difference.

I’ll choose door number 2.

Εγγραφή σε:

Σχόλια ανάρτησης (Atom)

Δεν υπάρχουν σχόλια:

Δημοσίευση σχολίου