June 30, 2010, 6:09 pm Iceland is, of course, one of the great economic disaster stories of all time. An economy that produced a decent standard of living for its people was in effect hijacked by a combination of free-market ideology and crony capitalism;

one of the papers (pdf) at the

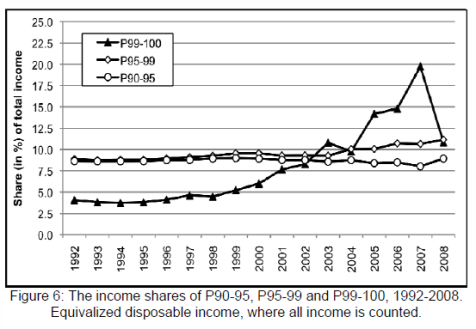

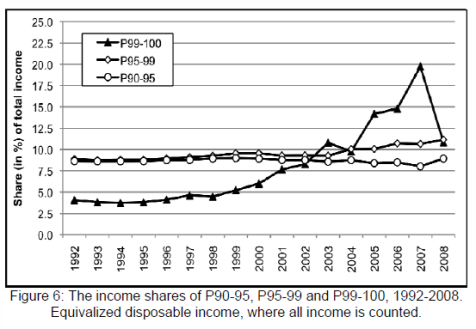

conference I just attended in Luxembourg shows that the benefits of the financial bubble went overwhelmingly to a small minority at the top of the income distribution:

Olafsson and Kristjansson

Olafsson and Kristjansson And in the process of building short-lived financial empires, a handful of operators built up enormous debts that their fellow citizens are now expected to repay.

But there’s an odd coda to the story. Unlike other disaster economies around the European periphery – economies that are trying to rehabilitate themselves through austerity and deflation — Iceland built up so much debt and found itself in such dire straits that orthodoxy was out of the question.

Instead, Iceland devalued its currency massively and imposed capital controls. [ΑΥΤΗ ΕΙΝΑΙ Η ΛΥΣΙΣ ΔΙΑ ΤΗΝ ΕΛΛΑΔΑ, ΜΟΝΟΝ ΑΥΤΗ!!!]

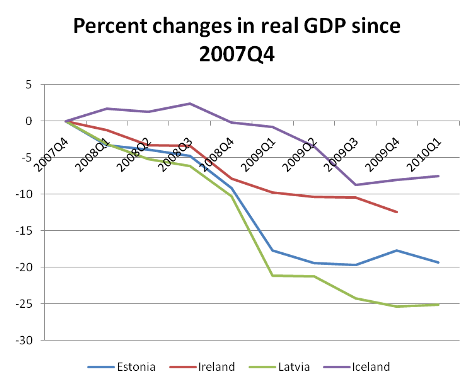

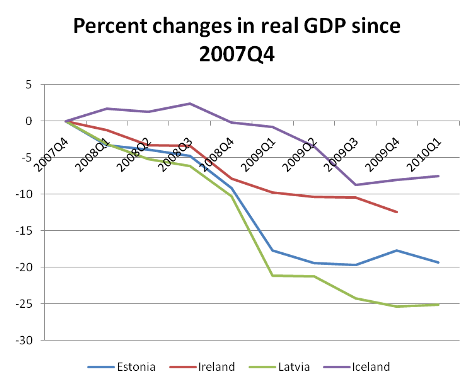

And a strange thing has happened: although Iceland is generally considered to have experienced the worst financial crisis in history, its punishment has actually been substantially less than that of other nations. Here’s GDP:

Eurostat

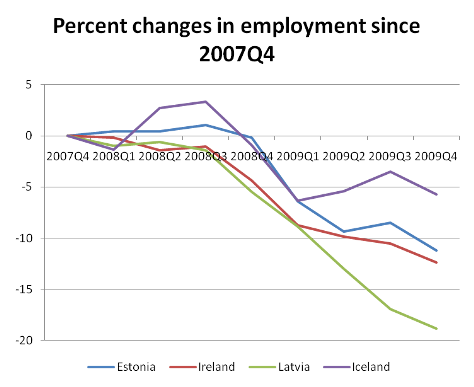

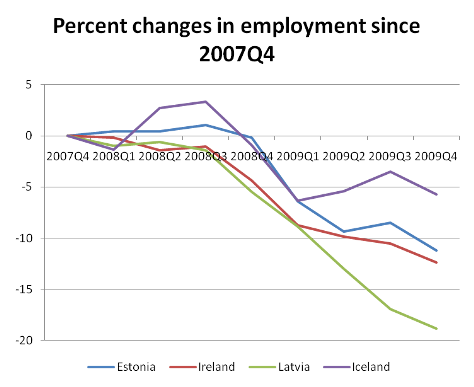

Eurostat And here’s employment:

Eurostat

Eurostat The moral of the story seems to be that if you’re going to have a crisis, it’s better to have a really, really bad one. Otherwise, you’ll end up taking the advice of people who assure you that even more suffering will cure what ails you.

Olafsson and Kristjansson

Olafsson and Kristjansson  Eurostat

Eurostat  Eurostat

Eurostat

Δεν υπάρχουν σχόλια:

Δημοσίευση σχολίου